Fridays data release was the proverbial USDA starting pistol for the 2023 growing season. The March Prospective Plantings and Quarterly Grain Stocks estimates are a chance (and the first one of the year) for the market to set a “benchmark” acreage estimate and shore up the remaining supplies left over from last year. These two numbers combined (alongside yield estimates, the remaining benchmark figure the market has yet to argue over), give traders a starting place for a balance sheet approach to fundamental analysis. After today's report the trade has a benchmark for how much 2023 will produce on top of what's left over giving the trade a clearer picture of total on hand and usable supplies.

WATCH: The Zaner Ag Hedge Senior Market Strategists break down the latest USDA planting intentions and quarterly grain stocks report.

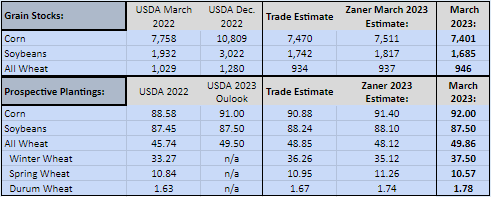

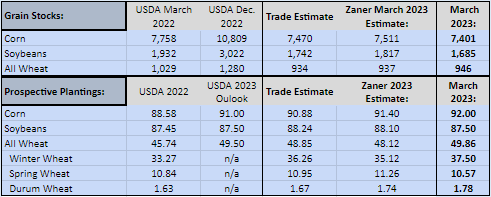

From Fridays report the USDA, announced an overall reduction in grain stocks in corn and soybeans which was more than the average trade estimates. Corn 1st quarter ending stocks came to 7.4 billion bushels, approx. 70 million below the average trade guess; Soybeans ending stocks were estimated 1.69 billion bushels roughly 50 million bushels below the average trade guess. Wheat was the one gainer, adding 12 million bushels coming in at 946 million bushels in 1st quarter ending stocks.

The USDA was a bit more mixed on the estimates on indented acres; with Corn and Soybeans both surprising the market for different reasons. Corn acres came in a 92 million, over 1.2 million more than the trade was expecting, and almost 2.5 million more acres than last year! On the contrary, Soybeans surprised the trade with a lower intended acreage estimate, of 87.5 million acres; which is almost .75 million less than the average trade guess and negligible 50k acres more than last year (that could be considered a "rounding error" with this size of data collection). Wheat acres also surprised the trade, coming in nearly 1 million more than the average guess, and 3.1 million more acres than last year. The question now: how many of those acres will come to fruition, and how many of those acres are still (as of April 2nd) still under a dense snowpack?

March 2023 Quarterly Grain Stock and Prospective Planting Intentions:

Now that the USDA has announced the 2023 Planting Intentions and March's Quarterly Grain Stock estimates; the trade has a benchmark for not only remaining supply but also an acreage estimate to being arguing over yields into this crop season. With the focus now off "how many acres" are we going to see, the trade should ultimately begin to decide the affects of potential weather events and the extent to which exports a domestic consumption will (or will not) continue to reduce stockpiles of old crop.

Receive the Zaner Ag Hedge analysis on the USDA Prospective Planting Report subscribe to the newsletter today.