Today is the proverbial USDA starting pistol for the 2023 growing season. The March Prospective Plantings and Quarterly Grain Stocks estimates are a chance (and the first one of the year) for the market to set a “benchmark” acreage estimate and shore up the remaining supplies left over from last year. These two numbers combined (alongside yield estimates, the remaining benchmark figure the market has yet to argue over), give traders a starting place for a balance sheet approach to fundamental analysis. After today's report the trade has a benchmark for how much 2023 will produce on top of what's left over giving the trade a clearer picture of total on hand and usable supplies.

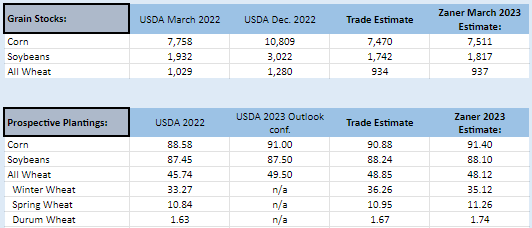

For today's report, due out at 11:00 AM CST, the trade is generally expecting lower grain stock numbers across all three majors (Corn, Wheat, Soybeans). For prospective planting intentions, the trade also expects a net increase across all three crops; expecting a rise in Corn acres of +2.3 million compared to last year, soybeans acres with a mediocre +.79 million acre increase over last year, with wheat gaining the most acres of +2.38 million compared to last year.

March 2023 Quarterly Grain Stock and Prospective Planting Intentions Trade Estimates:

|

Grain Stocks: |

USDA March 2022 |

USDA Dec. 2022 |

Trade Estimate |

Zaner March 2023 Estimate: |

|

Corn |

7,758 |

10,809 |

7,470 |

7,511 |

|

Soybeans |

1,932 |

3,022 |

1,742 |

1,817 |

|

All Wheat |

1,029 |

1,280 |

934 |

937 |

|

Prospective Plantings: |

USDA 2022 |

USDA 2023 Outlook conf. |

Trade Estimate |

Zaner 2023 Estimate: |

|

Corn |

88.58 |

91.00 |

90.88 |

91.40 |

|

Soybeans |

87.45 |

87.50 |

88.24 |

88.10 |

|

All Wheat |

45.74 |

49.50 |

48.85 |

48.12 |

|

Winter Wheat |

33.27 |

n/a |

36.26 |

35.12 |

|

Spring Wheat |

10.84 |

n/a |

10.95 |

11.26 |

|

Durum Wheat |

1.63 |

n/a |

1.67 |

1.74 |

Once the USDA has announced their estimates of the numbers, the trade will have a common benchmark penciled on the balance sheet; allowing focus to shift to the upcoming planting season, future weather markets, and of course domestic demand and export pace. The combination of all these figures creates a well rounded view of the supply and demand for corn wheat and soybeans respectively, and completes a view of the fundamentals affecting the current market conditions.

Receive the Zaner Ag Hedge analysis on the USDA Prospective Planting Report subscribe to the newsletter today.